Contents

- 1 Introduction

- 2 Scholarships at SNHU

- 3 Grants at SNHU

- 4 Student Loans at SNHU

- 5 Steps to apply for Financial AID at Southern New Hampshire University (SNHU)

- 5.1 Complete the Free Application for Federal Student Aid (FAFSA):

- 5.2 Add SNHU as a School Choice:

- 5.3 Submit any Additional Documentation:

- 5.4 Review Your Financial Aid Package:

- 5.5 Accept or Decline Financial Aid:

- 5.6 Complete Entrance Counseling (for First-Time Borrowers):

- 5.7 Sign a Master Promissory Note (for First-Time Borrowers):

- 5.8 Receive Your Financial Aid:

- 6 Conclusion

- 7 Financial Aid SNHU FAQs

- 7.1 Who is eligible to apply for financial aid at SNHU?

- 7.2 What types of financial aid are available at SNHU?

- 7.3 How do I apply for financial aid at SNHU?

- 7.4 Is there a deadline to apply for financial aid at SNHU?

- 7.5 How do I know if I’ve been awarded financial aid?

- 7.6 Can I appeal my financial aid package if I’m not satisfied with the amount?

- 7.7 What happens if my financial situation changes after I’ve been awarded financial aid?

- 8 More Financial Aid SNHU FAQs

Introduction

Welcome to our comprehensive guide on Financial Aid at Southern New Hampshire University (SNHU). If you’re considering attending SNHU or are already a student, you might be wondering how to finance your education. Fortunately, SNHU offers a variety of financial aid options to help you pay for college. SNHU believes that everyone should have access to a high-quality education, regardless of their financial background. That’s why we offer scholarships, grants, and loans to help students cover the cost of tuition, fees, and living expenses. This blog will provide an overview of financial aid opportunities and eligibility criteria at SNHU.

First and foremost, it’s important to understand that financial aid is a broad term that encompasses many different types of funding. At SNHU, our financial aid programs include scholarships, grants, federal student loans, and work-study opportunities. However, each program has its own requirements and eligibility criteria, so it’s important to understand the differences between them before you apply. SNHU students should read our blog on the login guide for mySNHU Student Portal 2023.

Scholarships at SNHU

Scholarship providers typically award scholarships based on academic achievement, athletic ability, or other criteria. Recipients of scholarships do not need to repay the financial aid. SNHU offers a wide range of merit-based and need-based scholarships, including the Presidential Scholarship, the Dean’s Scholarship, and the Opportunity Scholarship.

Grants at SNHU

Grant providers typically award grants based on financial need. Similar to scholarships, recipients of grants do not need to repay the financial aid. SNHU offers several need-based grants, including the Pell Grant and the Federal Supplemental Educational Opportunity Grant (FSEOG). Additionally, some states and private organizations offer grants to students who meet certain criteria.

Student Loans at SNHU

Federal student loans are another type of financial aid that can help you pay for college. Loans require repayment with interest, unlike scholarships and grants. SNHU participates in the federal Direct Loan program, which includes subsidized and unsubsidized loans. These loans are available to undergraduate and graduate students, and they offer flexible repayment options.

Nevertheless, SNHU offers work-study opportunities to eligible students who demonstrate financial need. These programs provide part-time jobs on or off campus. Students can use wages earned from jobs related to their field of study to pay for tuition and other college expenses.

In order to be eligible for financial aid at SNHU, you must complete the FAFSA. Financial aid programs from federal and state governments, as well as many institutional scholarships and grants, determine your eligibility. The FAFSA considers factors such as your family’s income, household size, and enrollment status.

In addition to the FAFSA, some SNHU scholarships and grants have additional eligibility criteria. For example, the Presidential Scholarship requires a minimum GPA of 3.5 and an SAT score of 1250 or an ACT score of 26. The Dean’s Scholarship requires a minimum GPA of 3.0 and an SAT score of 1050 or an ACT score of 21.

Our blog will answer frequently asked questions about financial aid at SNHU, such as how to apply, what documents you’ll need, and when you can expect to receive your financial aid package. We’ll also provide tips on how to maximize your financial aid opportunities and minimize your student debt.

Whether you’re a first-time college student or a returning adult learner, financial aid can help make your educational goals a reality. We at SNHU are committed to helping you find the funding you need to succeed.

Steps to apply for Financial AID at Southern New Hampshire University (SNHU)

Total Time: 10 minutes

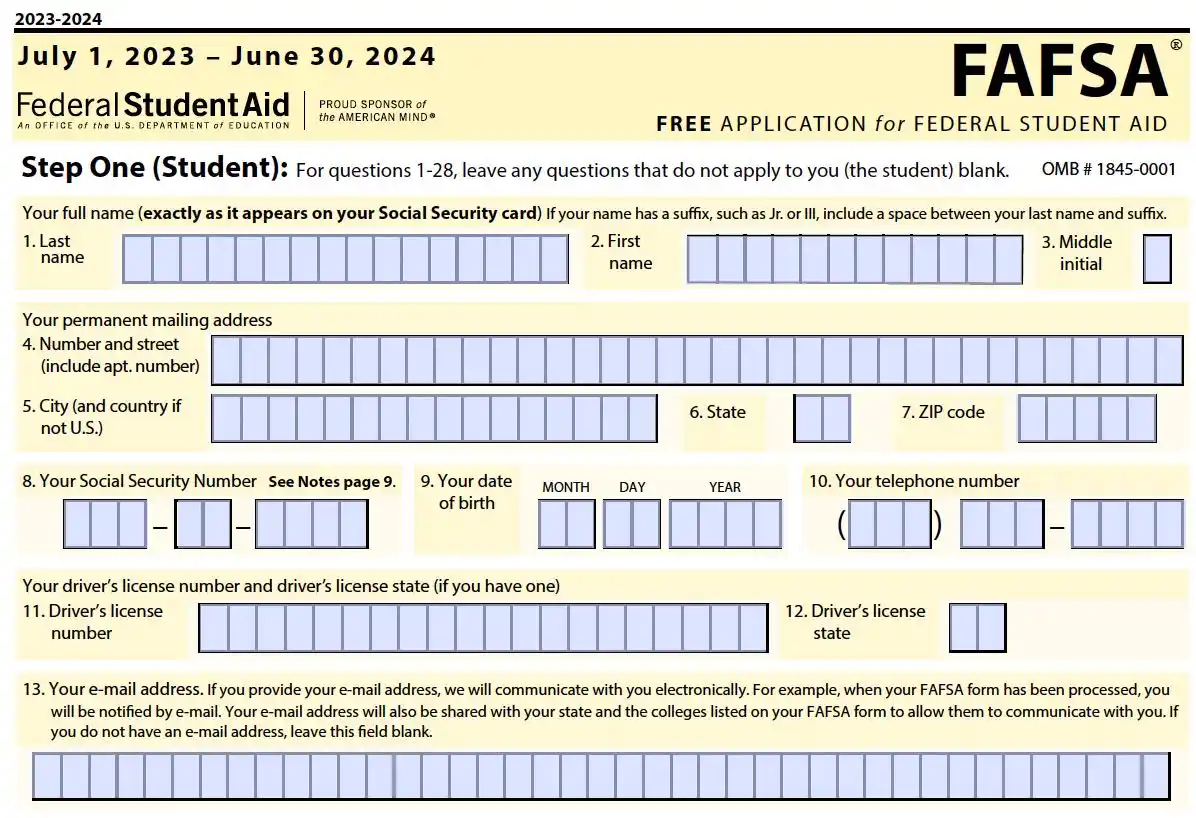

Complete the Free Application for Federal Student Aid (FAFSA):

The first step in applying for financial aid at SNHU is to complete the FAFSA. The purpose of this form is to assess your eligibility for federal and state financial aid programs, as well as various institutional scholarships and grants. You can complete the FAFSA online at fafsa.ed.gov.

Add SNHU as a School Choice:

When completing the FAFSA, make sure to add SNHU as one of your school choices. This will ensure that your FAFSA information is sent directly to SNHU’s financial aid office.

Submit any Additional Documentation:

After you’ve completed the FAFSA, SNHU’s financial aid office may request additional documentation to verify your eligibility for certain types of financial aid. This may include tax returns, W-2 forms, and other financial documents. It’s important to respond to these requests promptly to avoid any delays in the processing of your financial aid.

Review Your Financial Aid Package:

After processing your FAFSA and receiving any additional documentation, SNHU will send you a financial aid package that outlines the types and amounts of financial aid you are eligible for. This may include scholarships, grants, federal student loans, and work-study opportunities. It’s important to review this package carefully to understand the terms and conditions of each type of financial aid.

Accept or Decline Financial Aid:

After reviewing your financial aid package, you’ll need to accept or decline each type of financial aid. You can do this online through your student account on SNHU’s website. It’s important to consider the terms and conditions of each type of financial aid before accepting or declining, as some types of aid may have repayment or work requirements.

Complete Entrance Counseling (for First-Time Borrowers):

If you’ve been awarded a federal student loan, you’ll need to complete entrance counseling before the loan funds can be disbursed. This counseling will provide you with information on the terms and conditions of your loan, as well as your rights and responsibilities as a borrower. The counseling can be completed online through the Department of Education’s website.

Sign a Master Promissory Note (for First-Time Borrowers):

To receive your federal student loan, you must sign a Master Promissory Note (MPN) first. The MPN is a legal document that outlines the terms and conditions of your loan and serves as your promise to repay the loan according to those terms. You can sign the MPN online through the Department of Education’s website.

Receive Your Financial Aid:

Once you’ve completed all the necessary steps, SNHU will disburse your financial aid to your student account. Your financial aid disbursement may come in one lump sum at the beginning of the semester or in multiple disbursements throughout the academic year, depending on the type of aid you’ve received. It’s important to understand how and when your aid will be disbursed. This can impact your ability to pay for tuition and other expenses.

Conclusion

In conclusion, you can apply for financial aid at Southern New Hampshire University (SNHU) by completing the FAFSA, adding SNHU as a school choice, submitting additional documentation if requested, reviewing your financial aid package from SNHU, accepting or declining financial aid through your student account, completing entrance counseling and signing a Master Promissory Note for first-time borrowers of federal student loans, and finally, receiving your financial aid disbursement from SNHU. By following these steps, you can increase your chances of receiving financial aid from SNHU and minimize any delays in the process. Remember, financial aid packages can vary based on individual circumstances and funding availability, so it’s best to start the application process early and stay in communication with SNHU’s financial aid office. With careful planning and perseverance, you can make your dream of attending SNHU a reality with the help of financial aid.

Also, read our blog on mySNHU Student Portal Login Guide 2023.

Financial Aid SNHU FAQs

Who is eligible to apply for financial aid at SNHU?

To be eligible for financial aid at SNHU, you must be a U.S. citizen or eligible non-citizen, enrolled in an eligible program, and meet other eligibility requirements.

What types of financial aid are available at SNHU?

SNHU offers a variety of financial aid options, including grants, scholarships, work-study programs, and federal and private student loans.

How do I apply for financial aid at SNHU?

To apply for financial aid at SNHU, you must complete the Free Application for Federal Student Aid (FAFSA) and include SNHU as a school choice.

Is there a deadline to apply for financial aid at SNHU?

The deadline to apply for financial aid at SNHU varies by program and academic year, so it’s important to check with the financial aid office for specific deadlines.

How do I know if I’ve been awarded financial aid?

SNHU’s financial aid office will send you an award letter that outlines the types and amounts of financial aid you have been awarded.

Can I appeal my financial aid package if I’m not satisfied with the amount?

Yes, you can appeal your financial aid package if you have experienced a significant change in financial circumstances or if you believe there has been an error in the calculation of your financial need.

What happens if my financial situation changes after I’ve been awarded financial aid?

In case your financial situation changes after being awarded financial aid, you should get in touch with SNHU’s financial aid office to discuss available options. You may be able to receive additional aid or adjust your financial aid package to reflect your new circumstances.

More Financial Aid SNHU FAQs

What is the difference between a grant and a scholarship?

Both grants and scholarships are forms of gift aid that do not require repayment. However, scholarships are typically awarded based on merit or academic achievement, while grants are awarded based on financial need.

Can I receive both federal and state financial aid at SNHU?

Yes, you can receive both federal and state financial aid at SNHU, as long as you meet the eligibility requirements for each program.

Will my financial aid cover all of my tuition and fees?

Your financial aid may not cover all of your tuition and fees, especially if you have additional expenses such as housing or textbooks. It’s important to review your financial aid package carefully and consider other sources of funding if necessary.

Leave a Reply